Lithium, Explained

Lithium prices have soared as battery-dependent industries like electric vehicles and renewable energy have entered a renaissance. In China, lithium carbonate, the material used in battery production, is up more than 75% over the past year.1 Despite the excitement around this natural resource, lithium contracts do not trade on futures markets (like gold or oil), and therefore finding information and investing in the metal can be more nuanced than with other commodities.

The following analysis seeks to shed light on lithium by answering 7 questions:

- What is Lithium?

- How is Lithium used?

- Where does the demand for Lithium come from?

- What is Tesla’s impact on Lithium?

- How and from where is Lithium Mined or Extracted?

- What are the potential future prospects for Lithium?

- How can someone invest in Lithium?

What is Lithium and How Is It Used?

Lithium is the world’s lightest metal and has been dubbed “white petroleum” due to its common usage in state-of-the-art batteries. As demonstrated in the table below, lithium-ion is lighter, more efficient, and more durable than other competing technologies. This makes it a desirable choice for energy storage, particularly in vehicles and consumer electronics where weight and heavy usage is a significant consideration. These applications can include electric and gasoline hybrid vehicles, mobile phones, laptops, power tools and cameras, among other things.

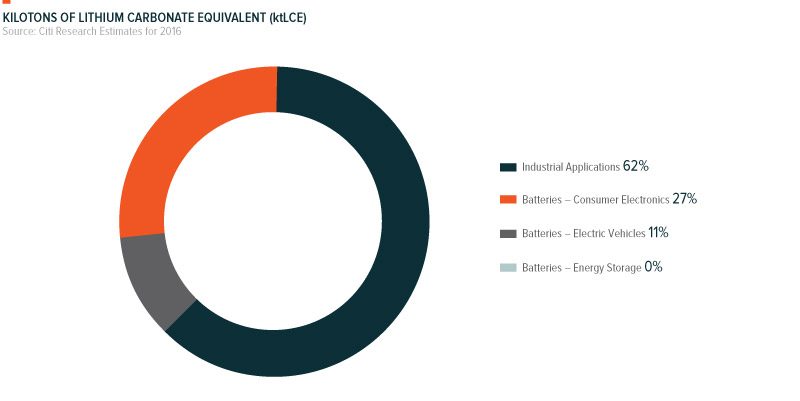

It is important to note that despite lithium’s common association with batteries, over 60% of current lithium demand comes from industrial applications, such as glass, ceramics, lubricants, and casting powders, as demonstrated in the chart below. However, much of the expected demand growth and optimism for lithium comes from the battery segment.

Source: Citi Research Estimates for 2016.

Where Does the Demand for Lithium Come From?:

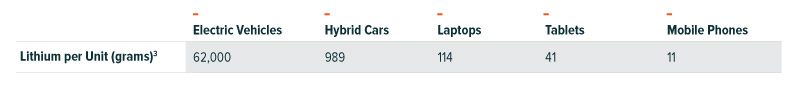

The biggest opportunity for lithium demand is expected to come from electric vehicles. According to Citi Research, an average electric car uses over 5,000 times more lithium than a mobile phone to power the vehicle’s range. Higher range electric cars, like the Tesla Model S, can use as much lithium as 10,000 smartphones.2 Therefore growth of the electric car market can have a significant impact on total lithium demand.

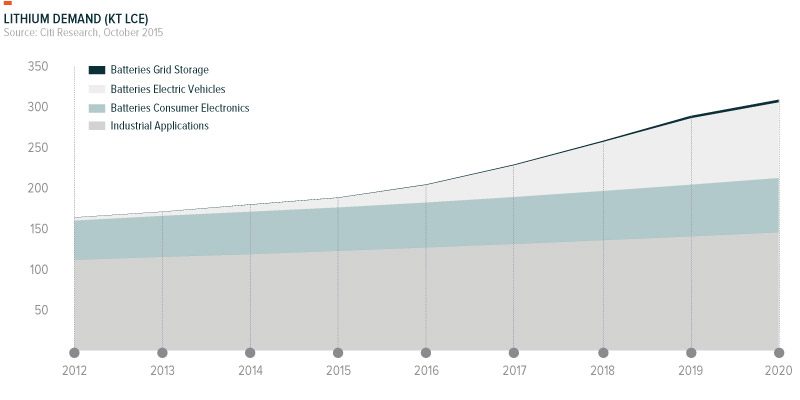

In 2015, car production consumed 15,000 tons of lithium, but by 2025 analysts expect this number to reach 136,000 tons, as electric and hybrid cars become more prevalent in the face of the clean energy technology movement.

Source: Citi Research, 2015.

According to SignumBOX, lithium accounts for less than 3% of the total costs of a lithium-ion battery.4 Given its relatively small influence on a battery’s economics, overall lithium-ion battery prices could fall from gains in production efficiencies, while lithium prices rise from increasing battery demand. Tesla, for example, believes that their Gigafactory will cut its battery costs by 30% by relying on economies of scale to improve efficiency.5 Therefore there is a negative cross elasticity of demand between lithium and battery prices that could result in rising lithium consumption and prices, while batteries get more affordable and common.

What is Tesla’s Impact on Lithium?

Tesla’s recently announced Model 3 received over 400,000 preorders (representing $14 billion in sales)6, while the company’s home Powerwall battery pack received over $800 million in presale orders.7 By the time Tesla’s Gigafactory is operating at full capacity, Tesla may consume 17% of total global lithium supply.8

Another important market for lithium demand will be China, which saw a 223% year-over-year increase in electric vehicle sales in 2015.9

How and from Where is Lithium Mined or Extracted?

Lithium deposits are most prevalent in South America, particularly in Bolivia, Chile, and Argentina, which together represent over 64% of the world’s reserves. China controls approximately another 26% of the world’s deposits.10 Currently, production in the lithium market operates under an oligopoly structure, with only a few companies controlling the vast majority of supply. However, new market participants have entered over the last few years as both lithium prices and demand have risen.

Lithium comes from two main sources: brine and hard rock. Brine deposits are found in salt lakes and lithium is extracted through an evaporation process. Brine harvesting is more common and often considered a simpler method of extraction, but generally of lower grade. Hard rock lithium mining requires geological surveys and drilling through rock, which can increase costs, but also often results in higher grades.11

There are 16 lithium projects estimated to begin production between 2016 and 2020. The majority of these are hard rock projects, which have the ability to come online relatively quickly given their shorter production lead times. Current hard rock projects require an average of 5 years of capital expenditures prior to production and an average mine life of 16 years. Brine projects require an average of 6 years of capital expenditures prior to production, but enjoy a longer life estimate of 30 years.12

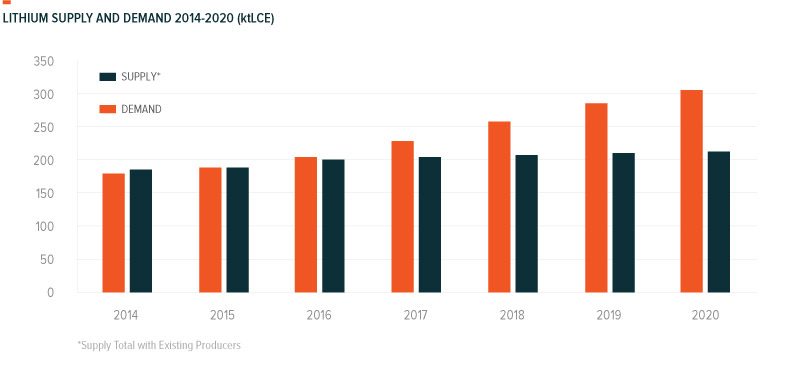

Based on production estimates by existing producers, there is expected to be a shortfall in the supply of lithium at least through the rest of this decade. Historically, supply shortfalls in a commodity lead to upward pressure in the underlying resource’s price. Estimates place the world’s lithium reserves at 183 years of remaining supply13, but given the time it takes to bring a new project to market, supply and demand forces could push medium-term lithium prices higher.

*Supply Total with Existing Producers

Source: Citi Research, 2015.

What are the Potential Future Prospects for Lithium?

There are three important trends that will continue to provide support for lithium demand growth over the coming years:

- Electric vehicles powered by lithium batteries continue to see scaling production levels and committed capital investments. By 2040, electric vehicles are expected to reach 35% of all new vehicle sales, as costs for lithium ion batteries decrease with improving technology.14

- Evolving consumer habits continue to drive increased mobile device adoption. Globally, mobile phone usage is expected to grow at an annualized rate of 3.4% from 2016 to 2019.15

- Electric grids continue to utilize lithium batteries as a method of energy storage, particularly for renewable sources like solar and wind. Demand for lithium batteries in energy storage is expected to grow at an annualized rate of 97% from 2016 to 2020.16

How Can Someone Invest in Lithium?

Unlike most commodities, lithium does not trade on futures exchange. Therefore, measuring changes in spot lithium prices or betting on future prices must be done through indirect exposure. One way to achieve this exposure is to invest in companies involved in various parts of the lithium cycle, which includes lithium mining, refining, and battery production. The Global X Lithium ETF (LIT) invests in companies involved in each stage of the lithium cycle and wraps this strategy in an ETF, allowing for efficient access to companies with high exposure to lithium.

Lithium prices have soared as battery-dependent industries like electric vehicles and renewable energy have entered a renaissance.

Source: Lithium Explained