Posted at Gold.org, “Record investment demand boosts global gold demand to an all time high in 2011 – Global demand for gold in 2011 rose to 4,067.1 tonnes (t) worth an estimated US$205.5 billion – the first time that global demand has exceeded US$200billion and the highest tonnage level since 1997, according to the World Gold Council’s Gold Demand Trends. The main driver for this increase was the investment sector where annual demand was 1,640.7t up 5% on the previous record set in 2010 and with a value of US$82.9 billion. The pre-eminent markets for investment demand in 2011 were India, China and Europe. …

Central banks continued the trend established in 2010 of being net buyers of gold. Purchases by central banks soared from 77.0t to 439.7t. This reflects the need to diversify assets, reduce reliance on one or two foreign currencies, rebalance reserves and ultimately protect national wealth. …”

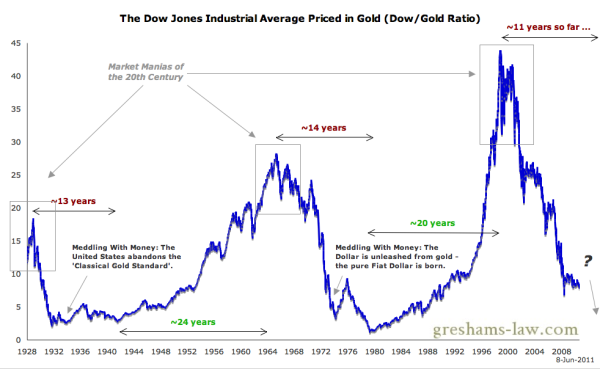

While the current gold value mega-cycle may have corrections from time to time, its uptrend appears well intact. If/when gold enters its mania phase is anyone’s guess. For me, all of the above charts provide a rationale of why there’s lots of room for gold to still go vertical, and where its top could be.

via.